Introduction

I’ve been wanting to write about this for a while after hearing a spectacularly interesting interview with one of the partners at the hedge fund Logica Capital - Mike Green. While I’m a novice when it comes to this stuff, my interest in it actually stems from a while back with this most recent interview prompting me to want to write about it.

I’m fortunate enough to work with a lot of really bright folks. Mathematicians, former philosophers, quantum physicists, you name it. At happy hour, I was talking with one of our quantum physicists over some beers about cascading effects of a graph network. Specifically, we were talking about how the markets are really just one giant undirected graph of nodes on a time series basis with each node having some impact or influence over another set of nodes. The conversation sparked something he came across in his education called quantum stochastic resonance (I’ll cover this in a second). The basic idea is that in randomness, you can increase a particular signal by boosting noise.

This, plus the interview with Mike Green, led me down a rabbit hole that is this article. Hope you all enjoy it!

First, Some Definitions

Stochastic vs. Resonance

Stochastic - Randomly determined; having a random probability distribution or pattern that may be analyzed statistically but may not be predicted precisely

Resonance - Increased amplitude that occurs when the frequency of a periodically applied force

While these are not directly opposing definitions, resonance implies a known probability or pattern that can be predicted. What happens when you bring them together?

Stochastic Resonance - A phenomenon in which a signal that is normally too weak to be detected by a sensor, can be boosted by adding white noise to the signal, which contains a wide spectrum of frequencies. If you really want to learn more about the history of this phenomenon, you can read more about it here.

Coherence Resonance - A phenomenon whereby the addition of a certain amount of noise in an excitable system makes its oscillatory responses most coherent.

We’ll come back to some of these definitions later.

Passive Investing in Index Funds and 401ks

I’m sure you’ve all heard the same advice from any talking head on TV or financial advisors. It goes something like this: “Invest in ETFs/401ks because they’re safe since your capital is more distributed across different sectors”. The other point most folks use is that the average yearly S&P500 return is 10% so why would you risk investing in individual stocks when you can almost guarantee a 10% return.

Vanguard funds are some of, if not the most popular way to invest in index funds due to their low expense ratios (typically .25%). Most folks put money in and “set it and forget it”. We do this with our 401ks in which most providers offer target retirement date funds. These are 401k portfolios typically comprised of varying ETFs or big-name individual stocks (think Microsoft) that are supposed to achieve a certain amount of money in them by the target data - your retirement.

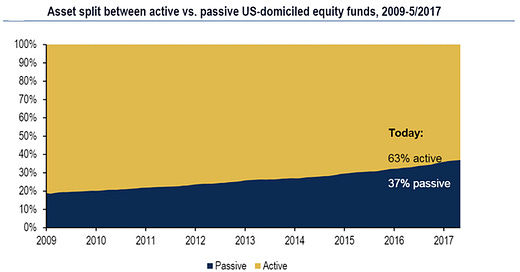

While we’re still in somewhat the early innings of passive investing, the change has some momentum as the chart exemplifies below. The growth rate is about 2.25%/year in favor of passive investing.

Since the 2008 great financial crisis, we have seen historically low-interest rates that disproportionately benefit the rich/wealthy - specifically companies. As an example, Amazon recently issued $10B in bonds with a weighted average cost for the debt coming in at 1.76%. Here’s the breakdown:

$1 billion due three years from now in June 2023, carrying an interest rate of 0.4%.

$1.25 billion due five years from now in June 2025, carrying an interest rate of 0.8%.

$1.25 billion due seven years from now in June 2027, carrying an interest rate of 1.2%.

$2 billion due ten years from now in June 2030, carrying an interest rate of 1.5%.

$2.5 billion due 30 years from now in June 2050, carrying an interest rate of 2.5%.

$2 billion due 40 years from now in June 2060, carrying an interest rate of 2.7%.

It’s worth noting that they already had $55B in cash and marketable securities. Why did this do this? Because the debt was so cheap that it made more sense to take it on than use their existing cash.

In contrast, for a small business to take on a smaller loan from a traditional bank, it will cost them between 2.58-7.16% with payback terms that are typically <10 years. As such, it is very difficult for smaller companies to compete.

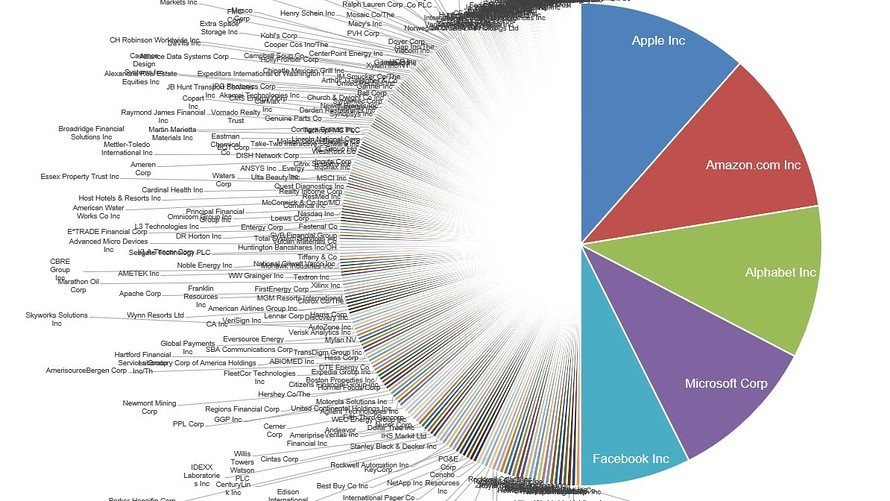

What this translates into is that with lower central bank interest rates, the big corporations continue to have access to capital that nearly everyone doesn’t, allowing them to compete more efficiently, scale more effectively, and weather storms much easier. This ends up producing higher revenues and earnings which, as a layman investor, looks promising from a long-term stock price perspective. This has led to an incredible concentration of capital into just a handful of companies. Here is the S&P500 composition by weight (pie graph is slightly dated since Tesla is in the mix now).

Here are the top 9 companies as of today by weight in the S&P500:

Apple - 6.7%

Microsoft - 5.3%

Amazon - 4.4%

Alphabet (Google, Class A & C) - 3.3%

Facebook - 2.1%

Tesla - 1.7%

Berkshire Hathaway - 1.4%

Johnson & Johnson - 1.3%

JPMorgan Chase - 1.2%

In total, they control 27.4% of the entire S&P500 in terms of weighting. It is not uncommon for one of the top 4 companies to be down for the day while the entire underlying index is up but still have the $SPY show a negative.

Apart from low-interest rates from central banks, how do we get such a high concentration of capital in each of these companies? Easy. Through ETFs. Here are the top 5 ETFs by assets under management (AUM):

SPY - S&P500 index fund

IVV - Mega & Large Cap for US companies; tracks $SPY

VTI - Total stock market; invests in US companies

VOO - Vanguard S&P500 fund

QQQ - Top NASDAQ broad market fund; lots of tech

If you click on any of the tickers above, you’ll see the holdings top 15 holdings. What you’ll also see is that the top 5-10 tickers are almost all the same. Through 401ks and passive investing, we are slowly creating an immense amount of concentration of capital into a handful of stocks.

What has also driven this is the Modern Portfolio Theory (MPT). This theory was created by Harry Markowitz in which provided a way for risk-averse investors to put capital into the markets for maximum expected returns with minimal downturns given a current market’s level of risk or volatility. It follows the same ideas of diversification and amplified the concept that ETFs are the route to go since you can expose yourself to a broad range of products (equities, bonds, treasuries, etc.) with great ease.

Coherence Resonance, Stochastic Resonance, and the Markets

It is my belief that what we are experiencing is a type of coherence resonance (CR). One of the more fascinating papers that I’ve read recently that discusses this specific topic is “Coherence resonance-like and efficiency of financial market” led by Guang-Yan Zhong. It’s a dense paper so proceed with caution.

What is interesting to me about this paper stands in the conclusion that Yan Zhong came to after running multiple modeled simulations off data from the CSI 300 Index. Yan Zhong states the following:

When coherence resonance-like behavior occurs, it indicates that the market is relatively orderly, highly predictable and inefficient.

On the contrary, when the anti-coherence resonance behavior occurs, it indicates that the market is less predictable and relatively high in market efficiency.

Let’s examine each of the bolded parts.

With a market behaving in coherence resonance, we see highly predictable pricing. However, we also see high inefficiencies. Why? With coherence resonance, you remove much of the volatility which is where price discovery happens to create a fair market value of a company’s stock. When everyone continues to buy the same thing, market coherence resonance is at an all-time high, creating high concentration and low volatility. An example of this is reviewing what PE ratios used to be from the 70s to 2005 versus today (PE ratios are way up).

When we see anti-coherence resonance, we see volatility go up (such as a correction) which makes predictability go down since our prior beliefs of coherence resonance are being challenged. Through the volatility, we see a market transform into higher efficiency because price discovery is happening actively as opposed to blindly.

So, the next question that this led me to was what could cause anti-coherence resonance to happen? The answer: nearly anything.

Yes, that is a completely non-answer and is stupid obvious but there’s more to it. Another great paper that I read was “Stochastic resonance as a model for financial market crashes and bubbles” led by A. Krawiecki. This is another deeper technical paper so if you don’t want to read through it, here is (in my opinion) the largest takeaway from the paper:

The main outcome of this investigation is that the apparently weak stimuli from outside can have potentially strong effect on financial markets by creating large price returns if they are enhanced by noise. Such stimuli can be a posteriori identifed with, e.g., the causes for crashes, although at their arrival nobody usually expects that crash occur. For this purpose the market has to be far from equilibrium, with most agents sharing the same orientation just before the crash or bubble.

Ok, a few things to unpack in this paragraph. The first is that “apparently weak stimuli”. What this means is that seemingly simple or innocuous events can create an order of magnitude more impact and effects on the market than people realize while going through the motions. As such, large price returns can happen if certain events are enhanced by noise.

It’s at this point that you should be saying “this sounds a lot like the whole GameStop/WallStreetBets debacle”. This is exactly that.

The second point here is that the market must be far from equilibrium in which agents are sharing the same or extremely similar orientation and position within the market for the crash to happen. This is exactly where Coherence Resonance plays its role. When all actors are doing the same thing, market is at an all-time high on coherence resonance, making it a prime moment for Stochastic Resonance to shine through. A seemingly stupid or unimportant event, such as GameStop, can cause a massive impact by disrupting the market’s coherence resonance.

When you amplify simple noises to create stronger signals that point to a shaky foundation, that foundation starts to crumble.

This gets completely exacerbated when you take into account the following chart:

The chart above is looking at Gross and Net long leverage of hedge funds. Currently, we are at an all-time high with gross leverage exposure being >260% and net exposure at around 85%.

What happens when stochastic resonance starts to disrupt a market that is leveraged to the max in coherence resonance?

The hedge funds start to run to cover by reducing their exposure. This looks like a couple of things. It looks like a rotation from highly concentrated stocks into defensive positions (consumer staples, defense contractors, energy/utilities) as well as hedge bets (bonds, treasuries, Bitcoin, volatility indexes).

This is really ugly because it means that a significant amount of capital needs to be rapidly rotated before they get caught with their pants down, thus spiking the shit out of volatility.

This is effectively what happened in March of 2020 where hedge funds knew that supply chain disruption was coming and consumer behavior was going to shift. Moreso than anything was that their world view of the markets coherence resonance broken down, creating a black swan event that pushed them into a defensive position which required a huge reallocation.

The challenge with this is that nearly all markets are impacted. When you are massively long on leverage and the market tanks, you, as a hedge fund, need to cover the difference in funding immediately (called a margin call). In order to do this, hedge funds normally raise outside capital to hold them over in bridge loans or lines of credit. However, in black swan events such as these, it requires selling securities because the credit markets have frozen up due to “unprecedented” uncertainty.

I suspect that we are about to see a repeat of March with volatility cascading throughout the system due to the highly illiquid state of these hedge funds.

Cascading Illiquidity

Going further down the research rabbit hole, I was led to this pretty amazing paper by Yongdeng Xu called “Illiquidity and volatility spillover effects in equity markets during and after the global financial crisis: An MEM approach”. This paper focuses primarily on how the impacts of illiquidity and volatility can spread throughout the globe.

Again, another technical paper so I’ll cut to the chase on what I found most interesting within the conclusion.

By comparing the spillover balance index between illiquidity and volatility, we find that illiquidity is a more important channel than volatility in propagating the shocks in global equity markets.

Our current illiquidity crisis makes me leery that this is going to end up causing much larger global disruptions than we are currently expecting (as well as WallStreetBets who want the world to burn). Creating an illiquidity crisis empirically generates more volatility both domestically and internationally, causing a domino effect to major markets around the globe.

This is what I’m actually worried about: people accidentally YOLO betting against their own countries demise so they can get a small piece of the wealth pie.

And they have every right to want to! Especially for Millenials, most have seen 3-4 recessions, the CPI going way up while wages stay the same, jobs being exported, shitty politicians, horrific federal debt leaves that bankrupt generations to come, and so much more.

They have found a way to fight back against the rigged system and they’re doing it with all their might. What they don’t realize is they’re waging war on the elites who created this rigged system that they are all held hostage to as well. We’re living in a real-world shit version of a Prisoner’s Dilema.

The Path Forward

So, I’ve painted a really bleak picture at this point. It sounds really bearish and not good. Well, unfortunately, I don’t think it is good and it could get ugly really fast. I had to rush to get this whole thing written out before the markets open on Monday, 2/1/2021 because I think we are just about to see the beginning of it.

What are some ways you can protect yourself?

There are some of the straightforward obvious ones which are reduce your debts, stay cash-heavy, reduce expenses, and HODL. But, let’s dive into some specifics for more active money management.

Go long $VXX. The $VXX is a volatility index that goes up when the market drops. This would be a hedge and offset losses in other parts of your portfolio.

Go long $TLT. The TLT is the 20-year treasury bond ETF and is generally good protection for when markets turn south.

Go long $UUP. The $UUP is a tradeable dollar index. As the world increases the demand for dollars to solve illiquidity problems, the $UUP stands to benefit. This is also a recently called out chart that is looking to break out of its falling wedge (funny how these events have lined up).

Go long $BTC. Bitcoin is a bet against the system entirely and buyers effectively opt to not play by the rigged game. In the short term, I think this is likely to be protective against wild market volatility as capital flees to safer havens. However, tread carefully here as it is possible to trade Bitcoin on margin so we may potentially see liquidation in Bitcoin to cover margin elsewhere.

This is not an extensive list but the current trades that stand out to me the most. I’m personally not going to be liquidating my 401ks or anything like that because in the long run, I do believe the markets will recover and outperform over a bigger time horizon (20-30 years).

I do fully suspect that the central banks/fed will step in to provide short term liquidity as they did in both 2008 and 2020. The feds helping provide liquidity does not mean that the markets won’t continue to fall because they will. This follows the anti-coherence pattern talked about earlier. The fed will provide liquidity for hedge funds to unwind and reposition capital, creating volatility because the market has moved into high efficiency in price discovery (aka - the lemmings have grown a brain and are operating independently instead of throwing money into the same places).

I will fully call this out in bold that I could be totally wrong on this and I sincerely hope that I am wrong. This is my best guess right now based on what I’m seeing.

My last piece of advice: do not panic. Whatever you do, don’t panic. Come into a scenario like this with open eyes, keenly observe, create protection, and stay patient. These moments can create some of the best times to invest. They reward those who patiently wait and aggressively listen for active opportunities to make returns. Those who are unemotional and patient will be rewarded with large returns.

We’re back at it again tomorrow with a daily recap. Consider this paper one of the monthly deep dives :)

- AO