Well. It’s been a minute. I hope you are all doing well. The world has been pretty boring lately, right? ;)

Once again, I’m back. Time continues to be the most precious commodity for me but it is for that exact reason that I’m writing today. Today, we’re going to talk about commodities.

I believe that there is a storm brewing that has the potential to wreak havoc on the global markets but also presents a massive opportunity to make money. It all starts with the Russia/Ukraine conflict so we will start there as I attempt to unravel what is going on. Strap in!

The Russia/Ukraine conflict is not even close to what most people think. Right now, western media is portraying Russia as the aggressor and bad actor here. While there is some truth to this, there are some much deeper truths in this.

First, let’s start with the USA. In general, we here in the USA like to think that we are the good guys. For the remainder of this article, suspend that belief.

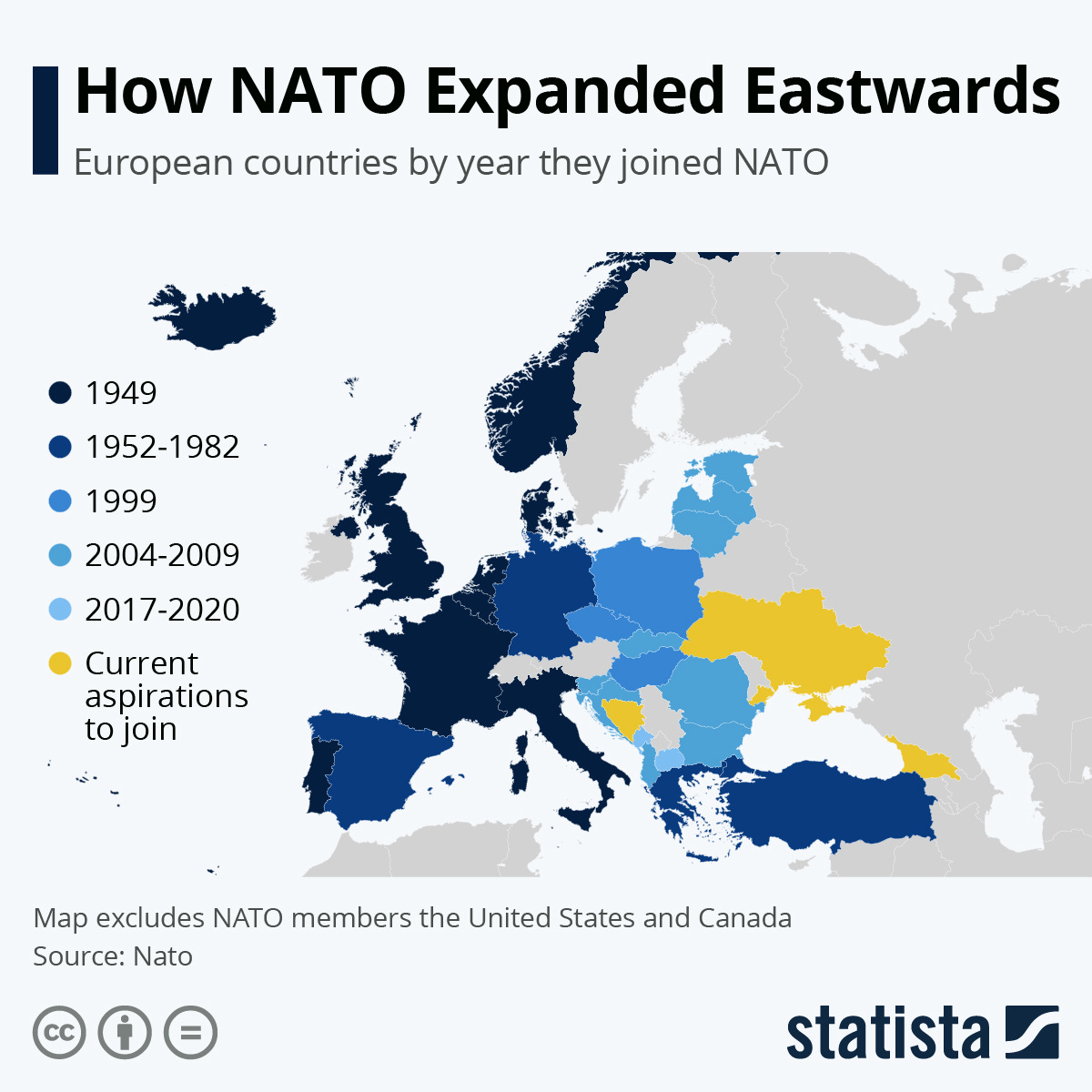

The world truly is one giant game of Risk that has been in a constant state of flux and chaos since the end of WWII. We had the cold war in which the USA ultimately came out on top but caused deep resentment within Russia because, in the minds of the Russian party and elite, Russia lost because Gorbachev was a weak leader. They never should have failed in their minds which is where Putin is at today. However, Putin is facing a new type of cold war with the USA and that is done through significant proxy wars in other countries that are friendly to the USA or are areas where the USA is attempting to expand its reach. Consider the following map of NATO membership expansion since inception:

The western front of Russia is littered with NATO members. Why does this matter? Per NATO membership, countries can host foreign military within their own country (eg. the USA has a significant presence in Germany). If you’re Russia, you’re viewing the NATO expansion as a border threat.

Then, Ukraine starts to get friendly with the USA/NATO instead of staying neutral. Ukraine has been riddled with conflict for a while and had broken multiple peace treaty agreements (specifically, the Minsk Agreement) in the Donbas region (southeast Ukraine). I’m skipping over a lot of details for brevity but highly encourage folks to read about the history of Russia and Ukraine with regard to Donbas.

In short, the USA has had involvement in overthrowing the 2014 Ukraine government through funding of a neo-nazi group called the Azov Battalion. Yes, you read that right - the US government was not only funding but providing military training for a neo-nazi group. This is a biased publication but does a decent job of a quick summary of this whole fiasco.

So, Ukraine wants to join NATO, hasn’t respected agreed-upon peace treaties, and there is empirical evidence that the USA helped fund an overthrow of the 2014 government that was pro-Russia. And…. we’re supposed to be surprised that Russia invaded?

Let’s back up one more time before we dive into the trade. Putin is a smart motherfucker and former KGB. For years, Putin has been increasing Russia’s energy supply to the broader EU across all fronts (oil, natural gas, Uranium, etc.). At the same time, there are large claims, from both sides, that Russia was funding Environmental Safety Groups to put policy pressure on reducing reliance on oil as a means to weaken their opponents. Another biased article but has some general context on the allegations.

How did this help Russia? Russia now provides 45% of natural gas imports to the EU and close to 40% of its gas. I can’t stress this next statement enough: The EU is completely and utterly fucked on the energy front for years to come.

Putin played the game and has already won; we’re just now watching everything else catch up. Putin invaded not to take over Ukraine but rather to provoke the USA into overreacting - which we did. As the Ruble tanked, Russia didn’t panic and instead spoke the words that has now launched the globe into a multipolarity world:

If you would like energy, then we can provide everything you need… but we only accept the Ruble.

Well. That didn’t work out as we expected.

So. What exactly has Russia done? Russia is making an attempt at taking down the US dollar as the global reserve currency and providing the world with a second alternative to settling commodities contracts (currently, they are predominantly settled in USD).

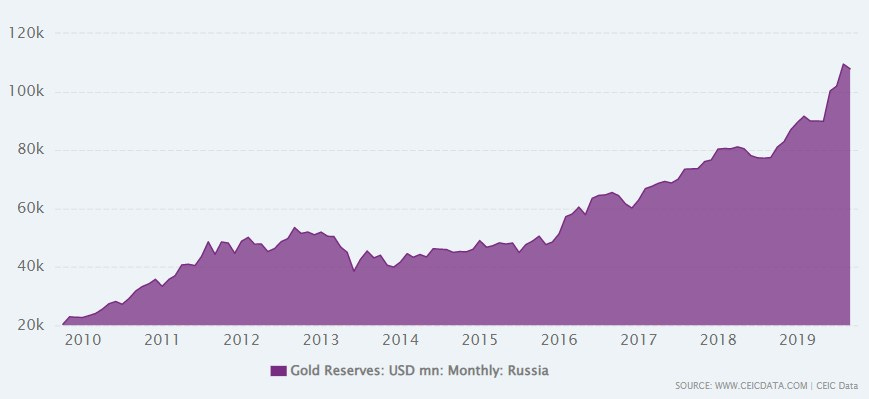

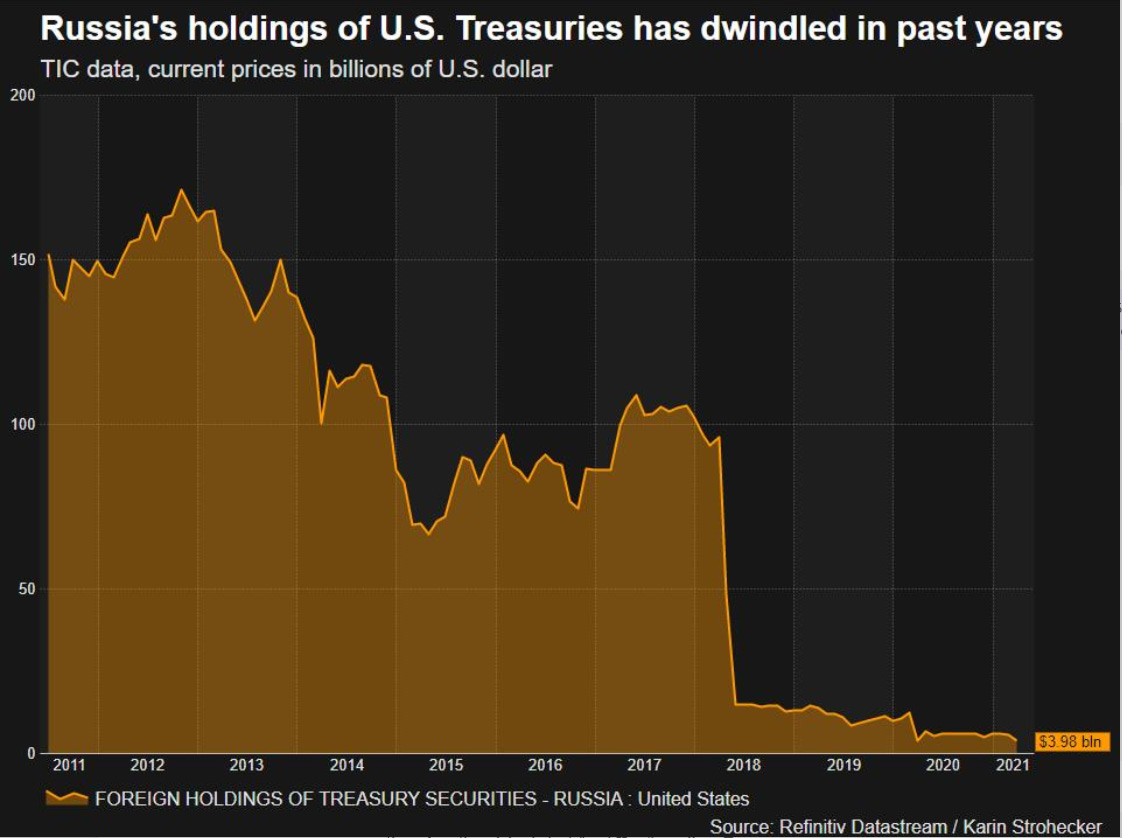

Russia wants to provide the world with an alternative global currency to settle in and they’re doing it by forcing the EU to transact with them in their own currency. We can see this clearly by the data. Russia ratcheted up their gold reserves and reduced their USD currency exposure leading up to this moment. The story was clear all along from these charts.

This is causing a major shock to the markets overall and dramatically shifts economic and political power in favor of Russia. Russia produces and contributes a significant amount of raw commodities to the world which is the underpinning engine that keeps much of the world moving forward. Of note are oil, natural gas, fertilizer, steel, and precious metals.

And now, the trade. Commodities and energy is the trade moving forward with some interesting substrates to play with. Let’s start with the big ones.

The $XLE printed a massive monthly inverse head and shoulders pattern that broke out to the upside. We’re over-extended now but that doesn’t mean the play isn’t valid anymore. We’re looking at MACRO charts here - these trades last years. I suspect that we are going to retest some prior highs.

But wait, let’s look at oil futures specifically.

We’ve cleanly and powerfully broke a >10-year downtrend on light crude oil futures and are still marching up. I suspect we will continue to trend up and that we could test $150/barrel.

Now, everything runs off of oil. When oil goes up like this, the price of nearly everything goes up. What about some other commodities that Russia is doing a lot of business in?

Uranium. $URA

This is one of the most incredible charts. There is a significant breakout and upside potential here.

A similar chart to this is the $REMX - rare earth and metals ETF.

Let’s zoom in on a metal specifically… Silver. Silver is heavily used in electronics and all the electronics you use on a daily basis require silver. So, what does the monthly silver chart look like?

A massive 40+ year cup and handle pattern that is damn near on the cusp of breaking out. Like, I can’t stress this enough… this is a massive trade in plain sight. Once the price breaks that downtrend channel, it isn’t unreasonable to assume that the price will go >$50/ounce, representing a near 100% gain from today’s price.

What about the things we eat?

Soybeans looking primed for a breakout over the next few years.

The FRED data is taking a peek outside of a symmetrical wedge with plenty of room to run higher.

Wheat has exploded as well but is over-extended to the upside right now. From a macro perspective though, the next decade is going to be expensive overall for wheat.

Lumber continues to rise in price as well which brings me to a very interesting hypothesis…

Hypothesis? The new housing building market is going to retrace significantly.

The $XHB ETF for home builders is trending down and entering a bear market territory. As interest rates go up, demand for new housing will fall leaving a bunch of homebuilders with SFHs that are too expensive to sell. This is fairly correlated to the $TNX rising which dictates mortgage interest rates.

Now, here’s the real question: will it break the downtrend? It hasn’t broken this downtrend since 1981. Here’s my bet: the increased interest rates will hurt the economy more than we expect and the feds will be forced to reduce interest rates again. This will mean that they will pause QT and go back to a QE policy, creating more cheap debt and more dollars overall. The cheap debt fuels “growth” and capital finds itself going to “high risk, high reward” investments. This aspect of the theory is corroborated by the $QQQ and $XBI potential reversal patterns emerging.

Oh, also… if cheap capital floods the market again, that would mean REITs go up because debt is cheap to get, right? Yeah, so check out $O - Realty Income. Tell me this doesn’t look like a breakout…

Another angle I’ve been looking at for the QE/interest rate reduction angle is the $DXY chart. In a nutshell, the chart is showing a potential increase in the dollar value - meaning demand is going to significantly increase for the dollar. What would cause this to happen? A liquidity shock.

When liquidity shocks happen, credit and debt can’t be repaid. This can happen in many scenarios… such as a bunch of home builders being unable to service their debts due to consumers’ inability to finance the purchasing of new housing… or if the supply chain of commodities that create the materials used in home building can no longer be purchased in the USD.

Liquidity shocks brew slowly and then happen all at once. How can this happen? Read this article again.

Will all this happen? Is this correct? I’m not sure. All I know is what I’m seeing in the charts and data. We haven’t seen the storm yet but we’re starting to feel the wind and some drops of rain. Macro events take long periods of time to play out with interstitial defining moments represented in major events, turning points, and shocks.

For me, I’m continuing to rotate into commodities, precious metals, and cryptocurrencies. Every crisis presents massive opportunities. I’m seeing plenty of opportunities right now.